01Monthly Reconciliation

Every month, we conduct a thorough reconciliation of all your accounts to provide you with a clear understanding of your current business figures.

02Profit / Loss Reports

We provide monthly reports on Profit and Loss, offering a detailed breakdown of business efficiencies on a monthly basis.

03Multiple Account Types

We perform comprehensive bank account reconciliations, covering all aspects from business credit cards to business operating accounts.

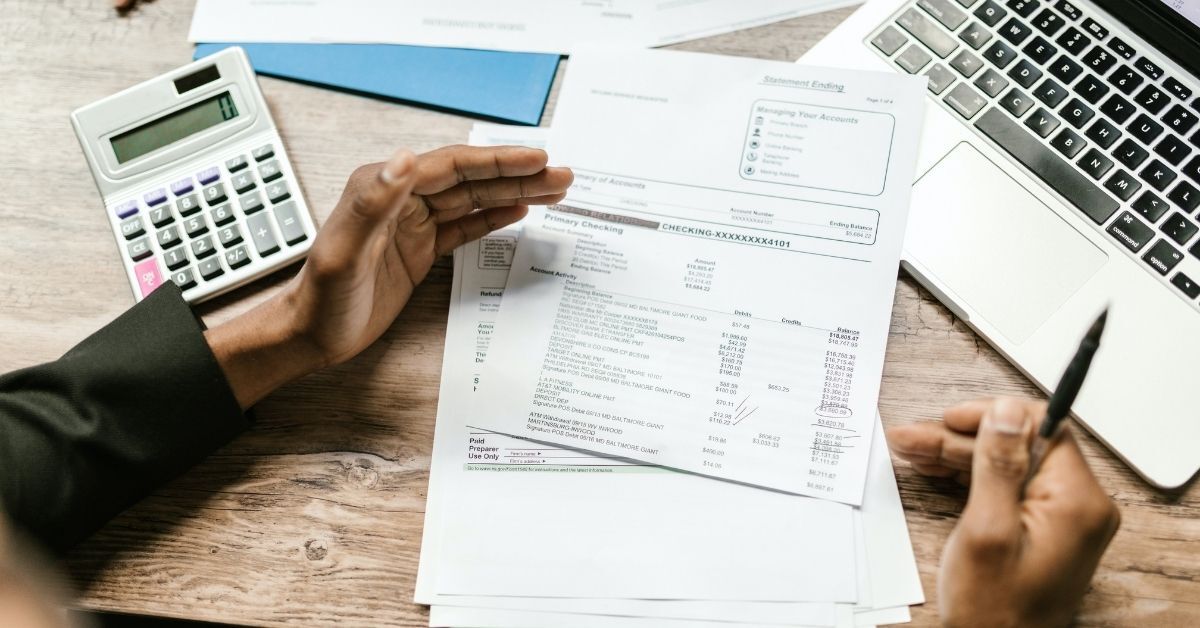

Statement Reconciliation

Bank reconciliation involves comparing the company’s internal records, including cash transactions and balances, with the bank statement to identify any discrepancies.

Matching Transactions

The reconciliation process entails matching individual transactions, such as deposits, withdrawals, and checks, between the company’s records and the bank statement.

Identifying Discrepancies

Discrepancies, such as missing transactions, errors, or timing differences, are identified during the bank reconciliation process. These variations are investigated to ensure accurate financial reporting.

Adjustments

Adjustments may be required to rectify discrepancies found during the reconciliation process. These adjustments could include recording outstanding checks, bank fees, interest income, or correcting errors.

Identifying Discrepancies

Discrepancies, such as missing transactions, errors, or timing differences, are identified during the bank reconciliation process. These variations are investigated to ensure accurate financial reporting.

Adjustments

Adjustments may be required to rectify discrepancies found during the reconciliation process. These adjustments could include recording outstanding checks, bank fees, interest income, or correcting errors.

Bank Errors

Bank errors or discrepancies in the bank statement are highlighted during the reconciliation. These errors should be promptly communicated to the bank for resolution.

Timing Differences

Timing differences occur when transactions are recorded in different periods in the company’s records versus the bank statement. Reconciliation involves adjusting for these timing discrepancies.

Unpresented Checks or Deposits

Unpresented checks or deposits refer to transactions recorded by the company but not yet processed by the bank. These items need to be reconciled to ensure accurate financial reporting.

Reconciling Adjusted Balance

The goal of bank reconciliation is to arrive at an adjusted bank balance that matches the company’s recorded balance, considering the identified discrepancies and adjustments.

Unpresented Checks or Deposits

Unpresented checks or deposits refer to transactions recorded by the company but not yet processed by the bank. These items need to be reconciled to ensure accurate financial reporting.

Reconciling Adjusted Balance

The goal of bank reconciliation is to arrive at an adjusted bank balance that matches the company’s recorded balance, considering the identified discrepancies and adjustments.

Regular Reconciliation

Bank reconciliation should be performed regularly, ideally on a monthly basis, to promptly identify and resolve any discrepancies, ensuring accurate financial reporting and effective cash management.

Book A Call